Australian Finance Group Ltd (ASX: AFG) wholly owned subsidiary AFG Securities Pty Ltd (AFG Securities) has priced an upsized A$700 million Residential Mortgage-Backed Securities (RMBS) issue.

This latest Non-Conforming RMBS transaction, AFG 2025-1NC, was upsized from A$500 million to A$700 million.

AFG Chief Executive Officer David Bailey said the transaction was well supported with a final order book in excess of A$1.7 billion. “The Class A1S to Class F notes were all publicly offered with interest received from more than 25 investors,” he said.

“The excellent coverage across notes enabled AFG 2025-1NC to price inside guidance and upsize to A$700 million,” he said. “The transaction was well supported with several new domestic and international investors participating in the transaction, reflecting the strength of AFG Securities as a reliable and trusted issuer.”

The Australian RMBS market is continuing to attract new domestic and offshore investors which is positive for the long-term stability of our program. “Once again, we are very pleased to see the support of AFG Securities and the opportunity to provide a competitive lending alternative for our brokers and their customers,” he said. “The support received for this transaction reflects our continued growth and ability to deliver exceptional results for our investors, our broker network and customers.”

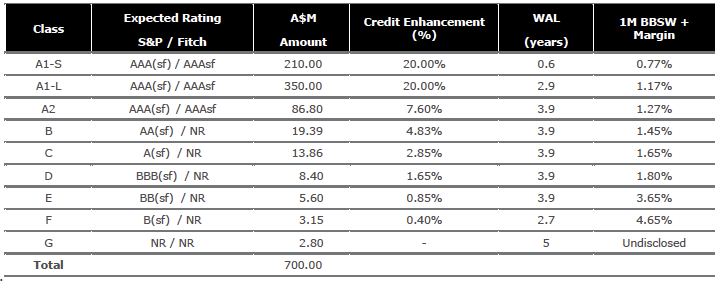

The transaction settles on Tuesday, 4th March 2025. Details of the notes are as follows:

-ends-